With 670+ votes, Wind.app became the #1 trending product on Product Hunt!!

Borderless Payments,

for Remittance Workers

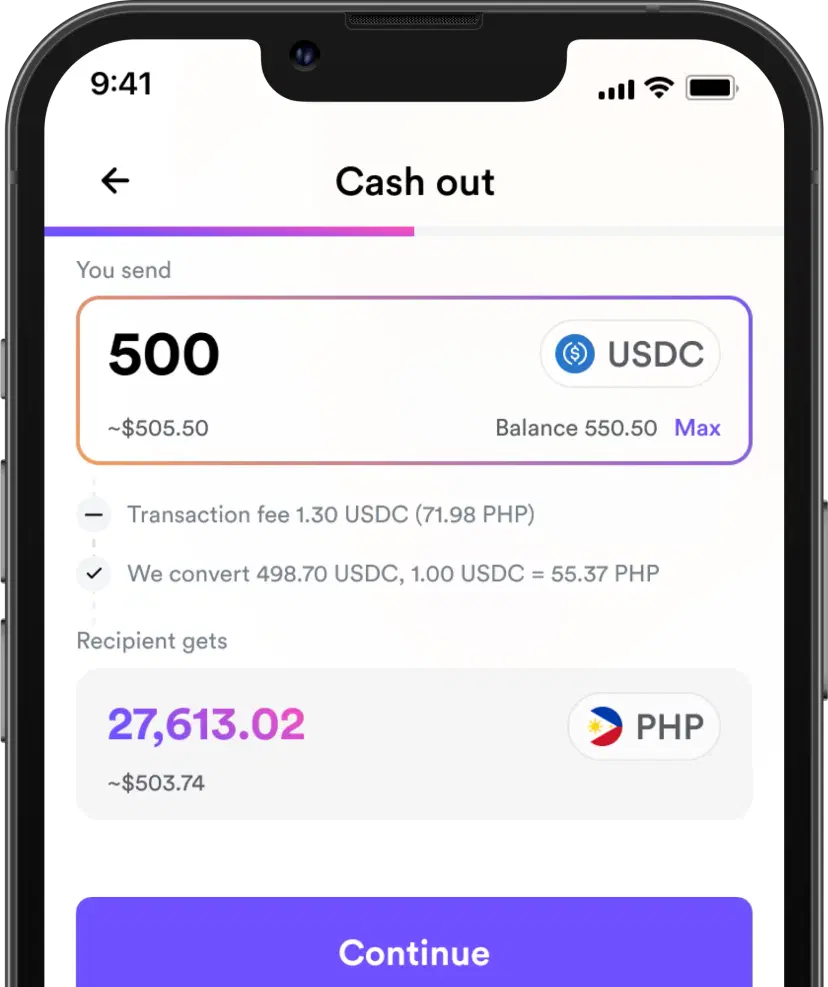

Send money to your home country and have the option to withdraw to your local bank account

Cash out money to your local bank account or e-wallet at the cheapest rates

Wind Business is tailored to meet the payment processing needs of remote companies worldwide, offering a seamless solution for managing payments efficiently. Its user-friendly registration process and the convenience it provides to employees for receiving payments and managing their finances make it an ideal choice for remote companies.

Wind supports multi-currency off-ramps worldwide

Also, Wind offers extensive support for a variety of banks and e-wallets, allowing users to choose the option that best suits their needs. With support for all major banks and e-wallets around Southeast Asia, Wind ensures a broad range of choices for users.

Additionally, Wind simplifies the process of adding funds to accounts for both individuals and businesses, offering competitive rates for adding funds via methods like ACH (for U.S. users), Debit, or Credit cards (globally). Users only need to provide their credit card details and a valid phone number for verification, making the process straightforward and efficient.

Wind delivers a comprehensive suite of benefits tailored to the needs of users seeking a reliable solution for international money transfers. It combines cost-efficiency, rapid transactions, and extensive support for financial institutions and e-wallets, making it the preferred choice for individuals engaged in global money transfers, including remittance workers, freelancers, independent professionals, and anyone seeking a convenient and cost-effective solution.